In today’s world, providing corporate actions solutions is quite a challenging business. The magnitude of manual activities and inefficiencies in corporate actions hinder the organization’s goal to create an enterprise-wide digital transformation, sometimes promote operational, compliance and complicate end customer queries ahead.

Understanding Corporate Actions

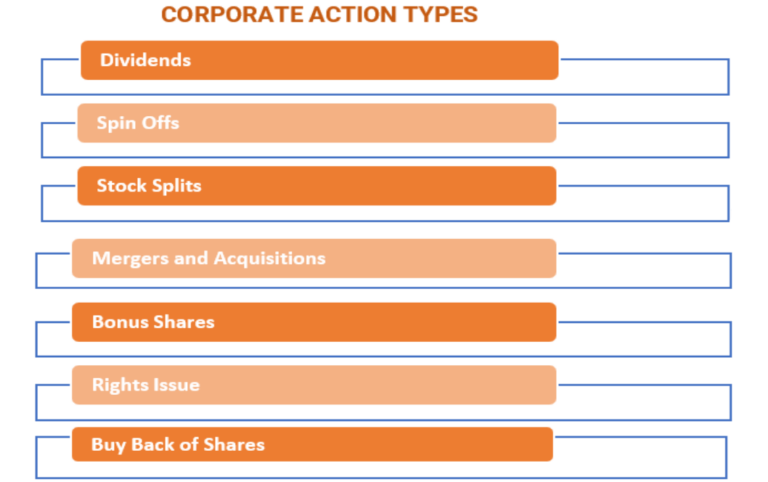

A corporate action (CA) is an event initiated by a public limited company that will bring an actual change to securities—equity or debt—issued by a company. CA is typically agreed upon by the board of directors and is authorized by shareholders. Common examples of corporate actions are Dividends, stock splits, mergers, acquisitions and spinoffs [1].

Corporate actions can be Mandatory, Voluntary & Mandatory with choice:

A Corporate action includes stock splits, dividends, mergers and acquisitions, rights issues, and spin-offs. All of these are major decisions that typically need to be approved by the company’s board of directors and authorized by its shareholders.

Cash Dividend

This is a common corporate action that alters a company’s stock price. A cash dividend is subject to approval by a company’s board of directors, and it is the distribution of a company’s earnings to a specified class of its shareholders.

Stock Split

This is another common corporate action that alters a company’s existing shares.

In a stock split, the number of outstanding shares is increased by a specified multiple, while the share price is decreased by the same factor as the multiple.

The Reverse Split

A reverse split would be implemented by a company that wants to force up the price of its shares. For example, a shareholder who owns 10 shares of stock valued at $1 each will have only one share after a reverse split of 10 for one, but that one share will be valued at $10.

Rights Issues

A company implementing a rights issue is offering additional or new shares only to current shareholders. The existing shareholders are given the right to purchase or receive these shares before they are offered to the public.

Mergers and Acquisitions

A merger occurs when two or more companies combine into one with all parties involved agreeing to the terms. In an acquisition, a company buys a majority stake of a target company’s shares. The shares are not swapped or merged. Acquisitions can be friendly or hostile.

The Spin-Off

A spin-off occurs when an existing public company sells a part of its assets or distributes new shares to create a new independent company. Often the new shares will be offered through a rights issue to existing shareholders before they are offered to new investors. A spin-off could indicate a company ready to take on a new challenge or one that is refocusing the activities of the primary business.

Challenges in processing Corporate Actions

Explore the latest Insights from Brickendon and ensure that your organisation is prepared.

Sources:

[1] Re-examining the Value Chain for Automation and Digitization | Hexaware

(https://hexaware.com/blogs)

[2] Automation in Corporate Action Process through Digitalization (itechseries.com) (https://resources.itechseries.com/itech-whitepapers)