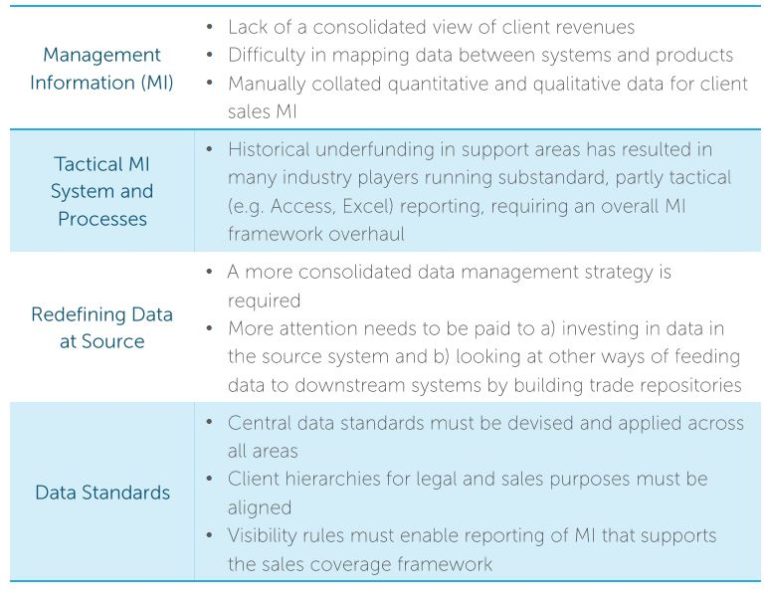

This introspection has revealed that many banks are unable to identify where the gaps are in their client activity. Sales reporting systems have typically been built in regional or product silos, mirroring business management structures. This has led to decentralised and inconsistent reporting infrastructures, which in turn gives rise to the global issue of data standards and data mapping. As a result, reporting teams must run extensive manual processes in an attempt to consolidate global sales data and cut it by client, across every region and by asset class. Following on from this, business management does not have the information needed to identify any “black spots” in the activity of key clients, and relationship managers cannot use this information to engage with clients and increase a client’s overall profitability.

Sales is not the only area that can benefit from this business partnering initiative. Regulatory reform has redefined a bank’s relationship with its client, as a significantly increased portion of this relationship is now of a regulatory nature. Having a view of client revenues on a consolidated basis will assist banks with prioritising clients for engagement on regulatory issues and rolling out the related regulatory change that affects the relationship.

Clients have become more mobile than ever before and will actively seek alternatives if the service offerings fail to meet their evolving business needs. Being able to access accurate and up-to-date client information is essential when offering tailored solutions that address a client’s business needs. We have observed that many banks are making no meaningful progress in this area as consolidating client information organisation-wide is extremely challenging due to the existence of severely disconnected and fragmented architecture that does not support the seamless flow of information upstream or downstream.